Fantasy Card Game-Battle card game Calvaria raced through stage 1 of its presale and is now 50% on its way to selling out stage 2 after passing the $350,000 mark.

The new gaming project is to revolutionize the world of blockchain gaming by solving one of its biggest problems – a small player base – in a unique way.

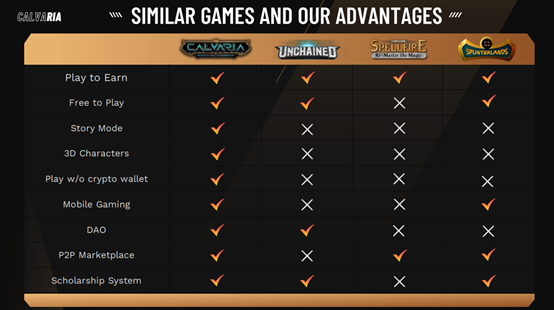

While previous play-to-earn (P2E) games have struggled to attract players, despite their great potential, Calvaria will release two versions of its main game, Duels of Eternity – one P2E and one free-to-play (F2P).

Calvaria Developers to Solve Two Blockchain Gaming Issues

The founders of Calvaria believe there are two major reasons casual and traditional gamers are not making the switch to P2E.

The first is that players can’t even try a game without it being prohibitively expensive – needing to purchase expensive NFTs or in-game tokens to take part.

The second is that players require some level of technical knowledge, such as how to use a crypto wallet, which can be offputting.

Calvaria is aiming to solve these two issues with its F2P game.

The game, which will be available in app stores, will be totally free to try and play, with developers hoping the game itself will attract some players over to the blockchain.

Secondly, the free version will include a visible tracker showing how much a player could have earned had they been playing the P2E version.

Finally, the F2P game will include a gamified educational mode that teaches players about blockchain technology and distributes rewards.

Visit Calvaria Presale Now

What is Duels of Eternity?

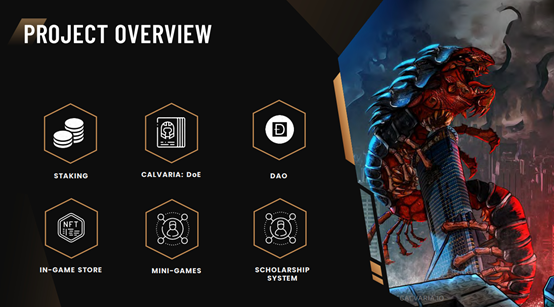

Duels of Eternity is the main game in the Calvaria ecosystem and is a battle card strategy that is set in the afterlife.

Players align to one of three warring factions – which have their own unique traits and strengths and battle other players using their wits, knowledge, and power-ups.

Furthermore, there is a single-player campaign that will expand the Calvaria universe and where players can earn unique cards and boosters that can be used in the player vs player mode.

To ensure continued growth and interest in the game in the future, Calvaria will incorporate seasonal versions and tournaments, as well as develop an eSports team.

Fantasy Card Game-RIA Token Presale

As mentioned above, the Calvaria token is currently in the second stage of its presale and has already sold more than $350,000 of RIA tokens.

Built on the super-fast blockchain Polygon, RIA is the main ERC-20 token of the ecosystem that will be tradeable on exchanges and power governing decisions in the Calvaria decentralized autonomous organization (DAO).

Another token eRIA, will exist for in-game purchases and will be the token used to distribute rewards in matches and tournaments.

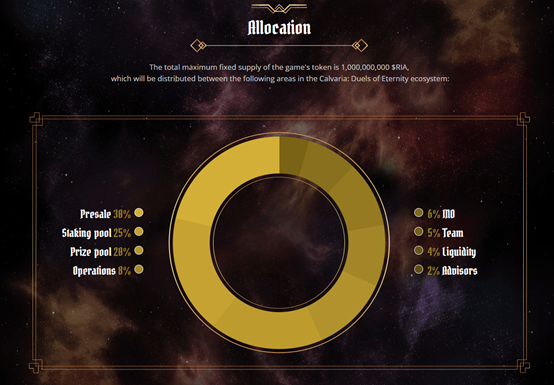

There will be 10 stages of the presale in all, with 30% of the max 1 billion supply for sale.

Read through the Calvaria whitepaper or join the Telegram group for more information.

Visit Calvaria Presale Now

U.TOWN:https://u.town/en