Bears, bulls and non-anthropomorphised crypto-market participants continue to speculate on the Bitcoin bottom. Metrics say yes… macro says nah, while technical analysis probably has a bet each way.One thing that is certainly consistent in crypto right now, though, is the market-sentiment reading – the Fear & Greed Index, which seems permanently switched to a forehead-dabbing “extreme fear” setting.

In search of a Bitcoin bottom

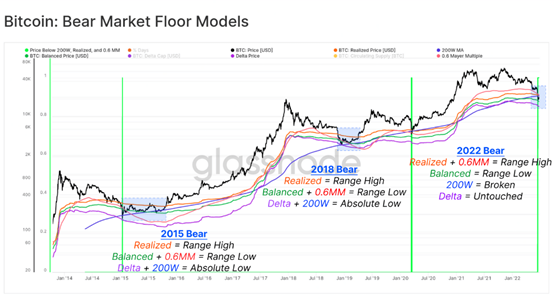

But as for that bottom talk, the excellent US on-chain analytics firm Glassnode is back at it with more searing insights. While caveating: “within the current macroeconomic framework, all models and historical precedents are likely to be put to the test”, its analyst “Checkmate” noted:

• Those who bought BTC in 2020 and 2021 have been largely responsible for all the recent selling (suggesting longer-term hodlers are still doing their thing – hodling).

• “Almost all macro indicators for Bitcoin, ranging from technical to on-chain, are at all-time lows, coincident with bear-market floor formation in previous cycles.”

• “Based on the current positioning of Bitcoin prices relative to historical floor models, the market is already at an extremely improbable level, with only 0.2% of trading days being in similar circumstances.”

And as you can see from the Glassnode chart below

it certainly looks very close to being a Bitcoin bottom when compared with previous bear-market cycles.In fact, with BTC currently closing and trading under the 200-week moving average for the first time, it would appear to be oversold compared with the previous lows.

Bitcoin believers may well be happy to keep dollar-cost averaging at these levels

The extra cautious, or maximum-opportunity hunters, however, might be waiting for something lower.IF, for example, Bitcoin were to come down around 80% to 85% (which has some precedent based on past bear markets) from its November 2021 US$69k all-time high, then, strap in, because, we could well be looking at BTC down at US$10k-US$14k levels.

Another, closer bottoming-out metric to consider, though, belongs to US financial technical analyst guru John Bollinger,

At these levels, maybe just a fraction south of US$20k, Bitcoin is “tagging” the bottom of his monthly timeframe BTC Bollinger Bands volatility indicator after posting a “picture perfect” double-top pattern in 2021. “This would be a logical place to put in a bottom,” he suggested.

As for the macroeconomic factors

shall we nutshell those again, too? May as well while we’re here… Crazy global inflation, 75bp Fed interest-rate hikes, Eastern European war, rising commodities, recession fears… not to mention the fact crypto is doing its best effort to implode from within.The full crypto-contagion narrative in the wake of Terra LUNA’s collapse is still being weaved, with the likes of Celsius, BlockFi, Voyager, Babel Finance, Coinflex, Three Arrows Capital and others all reportedly having a pretty rough time of things – some more than others. Although certain bailout vultures have reportedly sharpened their beaks and are circling for some.

U.TOWN:https://u.town/en